- Selling

- Buying

- Landlords

- Renting

- New homes

- House prices

- International services

International offices

China, Hong Kong SAR, India, Israel, Malaysia, Middle East, Pakistan, Qatar, Singapore, South Africa, Thailand and Turkey

Learn more - Contact

- News

- Contact

- About us

- My B&R

Inherited a property? Here’s what you need to know before renting it out

- Advice Clinic

- 05.10.18

- Vidhur Mehra

Contents

- 1. Decide who will own the property

- 2. Look at the finance options

- 3. Get permission to rent the property from your mortgage lender

- 4. Make sure you have landlord’s insurance for the property

- 5. Be tax-efficient

- 6. Claim all your tax allowances

- 7. Don’t get caught with a £5,000 fine

- 8. Airbnb is not a long-term solution – 90 days’ maximum

- 9.Think about whether you can manage the property yourself or need help

- 10.How do I find a reputable letting agent?

If you’ve recently inherited a property, you may be considering whether to rent out with a view to receiving a rental income and a real boost to your finances. All you need to do is find yourself a tenant and watch the cash roll in. Well, as you might expect, it’s not quite that simple!

Here are our top tips to maximising your return from inheriting a property, and minimising your inheritance tax liabilities.

1. Decide who will own the property

This might sound like an obvious question but there are several options in terms of company structures for owning a property and you will need to choose the most tax-efficient method, depending on your taxable income and personal circumstances. For example, this could be in a limited company or in a limited liability partnership (LLP).

This might sound like an obvious question but there are several options in terms of company structures for owning a property and you will need to choose the most tax-efficient method, depending on your taxable income and personal circumstances. For example, this could be in a limited company or in a limited liability partnership (LLP).

It might also be worth considering transferring the property directly to children or giving them a share in order to mitigate your Inheritance Tax liability in the future. Consult a property tax specialist who can advise you.

Stay up to date with the latest tax relief changes

2. Look at the finance options

Even if you have inherited a property without a loan or mortgage, you may find that it is more tax efficient to take out a mortgage and release equity. If the property is mortgaged already, you should compare lenders to see if you can find a better interest rate than the current one. Consult a financial advisor who can explain the options and show you how to operate your new business in the most financially efficient way.

Even if you have inherited a property without a loan or mortgage, you may find that it is more tax efficient to take out a mortgage and release equity. If the property is mortgaged already, you should compare lenders to see if you can find a better interest rate than the current one. Consult a financial advisor who can explain the options and show you how to operate your new business in the most financially efficient way.

Here’s our Top 10 tips for property investment in London

3. Get permission to rent the property from your mortgage lender

If the property is mortgaged, you will need to ask for formal permission from your lender (known as consent to let) to rent it out and this may mean switching from a residential mortgage to a buy-to-let one.

If the property is mortgaged, you will need to ask for formal permission from your lender (known as consent to let) to rent it out and this may mean switching from a residential mortgage to a buy-to-let one.

Watch out you don’t break the law by becoming an illegal landlord – here’s what to check for.

4. Make sure you have landlord’s insurance for the property

You will also need to contact your insurance company and arrange specialist landlord’s insurance – standard home insurance won’t cover a rental property and could be invalid if you have failed to inform the insurance company.

You will also need to contact your insurance company and arrange specialist landlord’s insurance – standard home insurance won’t cover a rental property and could be invalid if you have failed to inform the insurance company.

Avoid these 10 mistakes landlords can make

5. Be tax-efficient

Owning a rental property represents a significant change in your financial circumstances. For example, you will need to pay tax on your rental income, which will mean completing a self-assessment tax return, possibly for the first time. Talk to our accountants department who will advise on what needs to be done.

6. Claim all your tax allowances

Landlords are able to claim several tax allowances. For example, they can offset the interest they pay on their mortgage repayments against the income they receive from rent payments . Interest relief is gradually being restricted to the basic rate whereas previously it was available at the taxpayer’s highest rate of interest.

Landlords are able to claim several tax allowances. For example, they can offset the interest they pay on their mortgage repayments against the income they receive from rent payments . Interest relief is gradually being restricted to the basic rate whereas previously it was available at the taxpayer’s highest rate of interest.

Landlords can also claim a deduction for the capital costs of replacing furnishings and appliances in a rental property. The costs of fixtures that need to be repaired or replaced can also be deducted.

Rules regarding deductions do change and again, an accountant will ensure you are claiming all the deductions available to you.

Make sure you’re claiming all your entitled deductions

7. Don’t get caught with a £5,000 fine

Remember that the lettings industry is heavily regulated – there are over 150 pieces of legislation to comply with – from health and safety regulations to energy efficiency standards and tax. Breaching these (even unintentionally) could mean you are breaking the law and risking a fine of up to £5,000.

Remember that the lettings industry is heavily regulated – there are over 150 pieces of legislation to comply with – from health and safety regulations to energy efficiency standards and tax. Breaching these (even unintentionally) could mean you are breaking the law and risking a fine of up to £5,000.

Regulations dominate the private rented sector and complying with them is a complex and on-going process. You need to fulfil these requirements before putting the property on the rental market. This will include:

Making sure the property is ‘habitable’ – you must provide adequate heating and ventilation, lighting, sanitation and insulation. The property must be free of damp and mould.

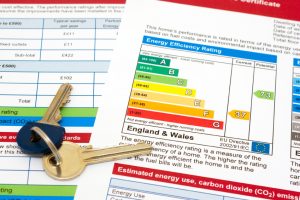

Arranging an Energy Performance Certificate (EPC) – every rental property must have an EPC rating of at least an E and cannot be marketed without one.

Organising a Gas Safety Certificate – this should be done annually by a Gas Safe engineer. Fitting smoke and carbon dioxide alarms is also advisable.

Portable appliance testing (PAT) – PAT checks are advisable every five years – there is an obligation to ensure all electrical equipment is safe.

Ensuring all furnishings meet Furniture and Furnishing Fire Safety Regulations (FFL). All upholstered furnishings must be fire resistant and have permanent labels attached.

Here’s our free landlords’ checklist.

8. Airbnb is not a long-term solution – 90 days’ maximum

Many landlords new to renting out their property think putting it on Airbnb as a short-term let is the easiest option. This couldn’t be further from the truth. In Greater London, residential properties can only be rented out for a maximum of 90 days without a change in planning permission. If you do so, you could be prosecuted and fined by your local authority.

Many landlords new to renting out their property think putting it on Airbnb as a short-term let is the easiest option. This couldn’t be further from the truth. In Greater London, residential properties can only be rented out for a maximum of 90 days without a change in planning permission. If you do so, you could be prosecuted and fined by your local authority.

You will also need permission from your mortgage provider, insurance company and possibly the freeholder of your building. These permissions may not be easy to obtain as short-term guests tend not to take as much care of a property as a long-term tenant would – so anti-social behaviour (having parties etc), extra damage and wear and tear are all real problems.

How to avoid nightmare tenants

9.Think about whether you can manage the property yourself or need help

With so much legislation to keep on top of (and potential pitfalls such as the Airbnb issues mentioned), managing a rental property can be a full time job. A property management agent will be invaluable, ensuring your property complies with the latest legislation. This will lift this responsibility from your shoulders and ensure all legal requirements are met – so you won’t risk breaking the law and a fine which could run to several thousand pounds – a wise investment.

With so much legislation to keep on top of (and potential pitfalls such as the Airbnb issues mentioned), managing a rental property can be a full time job. A property management agent will be invaluable, ensuring your property complies with the latest legislation. This will lift this responsibility from your shoulders and ensure all legal requirements are met – so you won’t risk breaking the law and a fine which could run to several thousand pounds – a wise investment.

It pays to remember too that most companies (over 95%) will not allow their employees to sign a tenancy agreement without professional property management in place.

A professional property manager will take care of all the day-to-day issues, from collecting the rent (and chasing unpaid rent) to organising inspections (gas and electrical safety) and other legal requirements such as Energy Performance Certificates, as well as property repairs and maintenance and carrying out inventories.

Top ten issues that will devalue your London rental property

10.How do I find a reputable letting agent?

You should choose a member of a professional trade body such as ARLA Propertymark – members abide by a strict code of conduct – you can search for a member at https://www.arla.co.uk/.

You should choose a member of a professional trade body such as ARLA Propertymark – members abide by a strict code of conduct – you can search for a member at https://www.arla.co.uk/.

They should offer a full range of professional lettings services, from finding and referencing potential tenants to drawing up a tenancy agreement, as well as keeping you up-to-date with legislation.

Your checklist on choosing the best letting agent

If you are renting out a property for the first time, and would like to find out more about how we can help you manage it efficiently, contact our property management department.

Sign up to our newsletter

SubscribeHow much is your property worth?

Media enquiries

About the Author

Vidhur studied Management Sciences at Manchester University, focusing on accountancy, before going on to qualify as a chartered accountant. He began his career working in investment banking but after several years decided to join Benham and Reeves in 2003. Since then he has expanded the finance department, introducing a broader range of services to encompass all financial aspects of property investment, from collecting rent through to completing tax returns (or ATED returns for overseas companies). Read more about Vidhur Mehra here - Read full profileView all posts by Vidhur Mehra

Avatars by Sterling Adventures