London property has a Lazarus-like ability to resist economic uncertainty. Just when all property market watchers were speculating that buy-to-let would falter, it remains robust and the latest research from Benham & Reeves Estate Agents shows, in fact, there are new opportunities appearing.

In 2015, when the Bank of England made strong recommendations that the UK buy-to-let market should be controlled, the government set in motion a series of measures to do just that. First there was the reduction in mortgage interest relief for buy-to-lets and the removal of the 10% ‘wear and tear’ allowance; then in 2016 there was the 3% addition in Stamp Duty on any property that isn’t the main residence. Predictions that these would result in a “stampede” of landlords selling their property portfolios but the reverse happened – agents were swamped with buyer interest (HMRC figures show that 45% of properties bought in Q3 2016 were buy-to-lets or second homes).

Even Brexit concerns have done little to shake landlord confidence. Research from Q4 2016 showed that four out of five landlords planned to continue to invest in buy-to-let properties with 3% saying they planned to invest even more than they would have done under normal circumstances. Only 9% were postponing their portfolio’s expansion until they could be clear on what the post-Brexit market would look like and only 3% said they would look to sell some of their portfolio. Moreover, Brexit has brought a dip in the value of the pound and so too additional foreign investment in the London market.

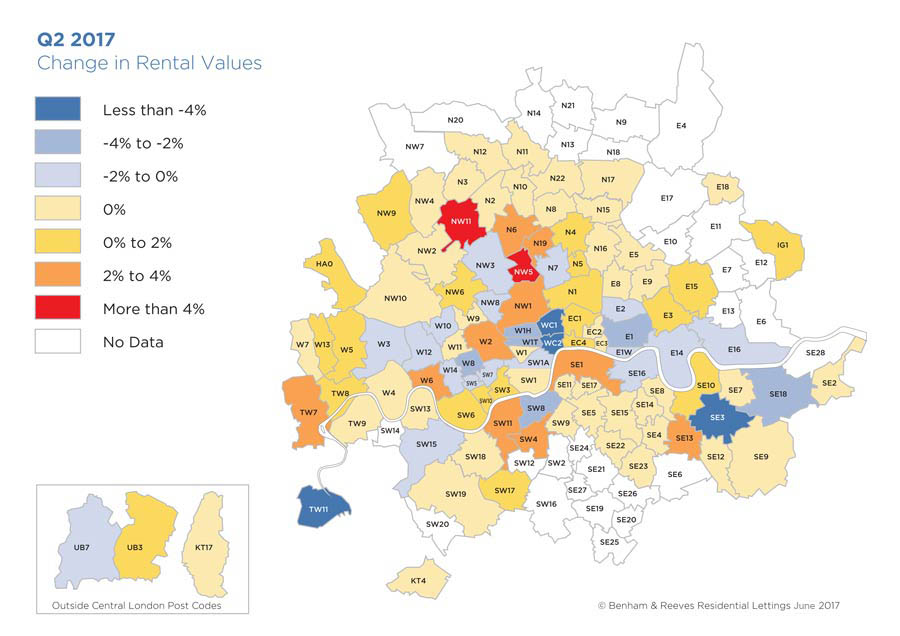

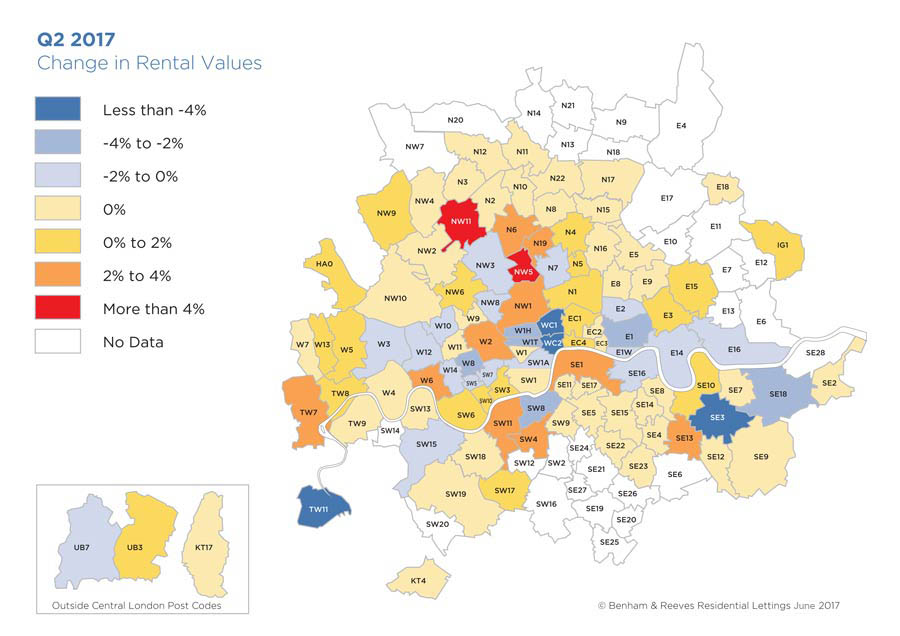

Demand for high-quality rental properties in prime locations is still rising and, if landlords can weather the storm of the tax changes, there are still good returns to be made from the investments. Our research showing rental value rises certainly confirms this. Stand out postcodes are seeing a rental value rise of between 2% and 4% (such as W2 Paddington and SE1 Southwark), while NW11 (Golders Green, Hampstead Garden Suburb, Barnet) and NW5 (Kentish Town, Camden, Gospel Oak) are experiencing rises of more than 4%. While many more, historically desirable areas to live such as N3 (Finchley), E5 (Clapton, Stoke Newington) and SW1 (Whitehall to Victoria) are holding stable showing no increase but no drop either.

In fact, infrastructure developments such as the Crossrail and urban regeneration projects such as the stunning Nine Elms (Battersea Power Station) development are also opening up areas to residents that had hitherto been overlooked. Our research shows an 8.5% increase in enquiries for the Battersea and Nine Elms postcodes compared with Q1 2017. In addition, we have seen very few clients exit the rental market this year – most are actively looking to invest further with professional investors capitalising on new rental hotspots.

Regardless of the Brexit uncertainties, property remains a comparatively safe investment. The fact that housing stock continues to fall short of demand – coupled with inflation that has outstripped wage growth – means the UK property market is out of reach for many first-time buyers. The result is a rental market that has never seen such demand. Our figures show 12.3% more letting transactions compared with Q2 2016.

International offices